Welcome to Coconut Twist

Claims GPS Case Stories provide guidance that your clients and prospects can and will relate to.

Ms. Sally Somebody’s horror story will display how:

The association board members are exposed due to lack of no preparation.

The catastrophic collapse of these three claims events was preventable.

These costly errors increased legal costs and exposures to future law suits.

Below is an excerpt of one of the case stories you'll be receiving.

Coconut Twist

THE TRUTH AND TRAUMA OF A HURRICANE INSURANCE CLAIM

Author: Mark Phillips

Copyright 2021: No reprint without permission permitted.

She had arrived in Coconut Twist to retire and enjoy her golden years in “the other half of the sunshine”. Sally had daydreamed for years in her Vermont hometown of the tropical warmth and relaxation awaiting her in Florida.

But it was that unpredictable hurricane season that blew around each summer that put an end to her enjoyment of that long-awaited dream. And it produced for her a catastrophic nightmare that one does not recover from with a strong cup of coffee.

The Florida Scrubber Hurricanes

It all began soon after she arrived in the Coconut Twist Condominium Association. She loved the comfortable and scenic setting of her new home. She was also soon identified as one of those nice caring ladies with a can-do spirit who could be counted on. So, it wasn’t long before the Association Board of Directors received a nomination for her to be on the Board. Saying yes to this leadership position only led to other responsibilities and, before long, she was elected as the Secretary / Treasurer. This gave her a five year run of constant record keeping of financials, maintenance records and legal filings as required by the State. But it was the last four years, during which the 2004 and 2005 hurricanes sliced throughout Florida, that her lifestyle was disrupted with deep seasons of panic, headaches and a dastardly gray cloud of despair over each and every day of her life. Walk with Ms. Sally through the trauma and nightmare of three hurricane claims investigations that disrupted her daily happiness and added relentless stress.

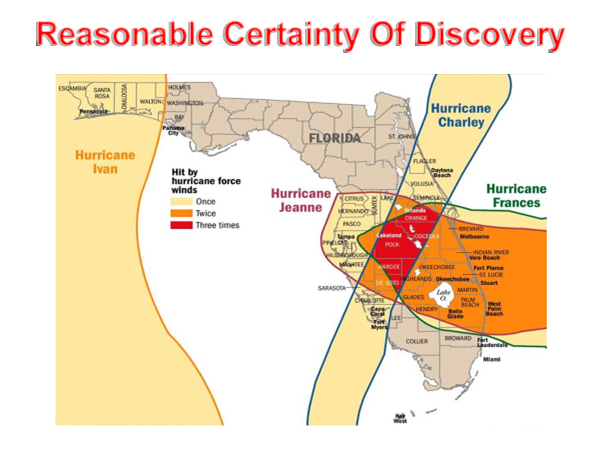

Three hurricanes blew through the Coconut Twist county in 2004 and 2005. Three separate claims were filed for the property damages that occurred in each storm, with a combined property loss estimate of over $12 million. Subsequently, all three claims adjusting events, along with requirements from the three separate insurance companies investigating each claim, created an unending chore for her to satisfy each of their demands for maintenance and financial records. These demands could only be handled by her since she was the controlling board officer with any awareness of Association records. It fell to her to promptly and accurately provide the documents in order for the adjustments and proper settlements to be completed.

The Insurance Company’s Rights

One would think, particularly since never being involved with a large property damage claim, that all you had to do was call your insurance agent, timely report the claim and all would be handled promptly within a few months. Well, let’s see what that thick document, called the Condominium Association Commercial

Insurance Policy, might have to say about her role and the records of the Association. And this is where the nightmare began, in a little old paragraph stipulating the rights of the insurance company should a claim be filed.